Nearly 60% of U.S. adults have no estate planning documents in place.

Your greatest gift is often your legacy gift. Many people who have been blessed by Focus on the Family have decided to leave a legacy gift through their estate. A bequest is one of the easiest gifts to make. As you create or update your will, trust, retirement plan or life insurance, you can specify that a gift goes to Focus on the Family.

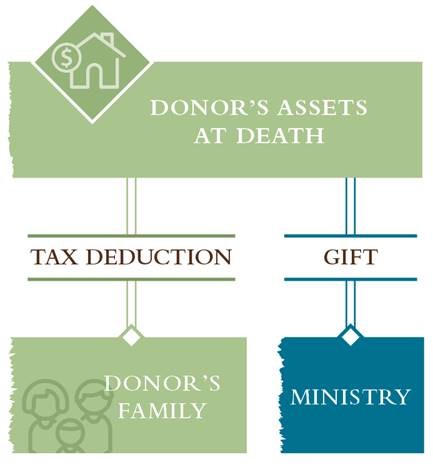

Benefits of a charitable bequest

- A bequest gift can lower your taxable estate

- Based on your net worth, you may be able to reduce the amount of taxes that your family is obligated to pay

- Leave a lasting legacy gift to Focus on the Family, yielding eternal impact

Via your will, trust or beneficiary designation in your retirement plan, life insurance or annuity:

- Specific dollar amount

You can list a specific dollar amount to be distributed to Focus on the Family. This approach provides certainty and simplicity. - Percentage bequests

A specific percentage of your overall estate can be left to charity. For example, you can designate 10% of your estate to Focus on the Family or to your local church. - Bequest of residuary

You can also direct that Focus on the Family should receive a percentage or fraction of your remaining estate after all expenses, debts, taxes and other specific bequests have been paid.

Via a charitable trust or charitable gift annuity:

In addition to a direct gift to Focus on the Family, a gift can be structured to share the benefit with family members and loved ones. For instance, a gift can be made that provides income for yourself, spouse or others with the assets eventually going to charity after their death or after a specified term of years.

Sample Bequest Language

In order to make a bequest, you should speak with your attorney. Your attorney can help you include a bequest to Focus on the Family in your estate plan. We have provided some basic bequest language to assist you and your attorney.

1. Bequests of a Specific Dollar Amount

If you would like to include a bequest of a specific amount of money to Focus on the Family, we suggest the following language:

I hereby give, devise and bequeath _________ dollars ($__________) to Focus on the Family, a nonprofit organization located at 8605 Explorer Drive, Colorado Springs, CO, 80920, Federal Tax ID #95-3188150, for Focus on the Family’s general use and purpose.

2. Bequests of a Percentage of Your Estate

If you would like to include a bequest of a percentage of your estate to Focus on the Family, we recommend the following language:

I hereby give, devise and bequeath ____ percent (___%) of my total estate, determined as of the date of my death, to Focus on the Family, a nonprofit organization located at 8605 Explorer Drive, Colorado Springs, CO, 80920, Federal Tax ID #95-3188150, for Focus on the Family’s general use and purpose.

3. Bequests of the Residue of Your Estate

If you would like to include a bequest of some or all of any remaining assets of your estate (after your specific bequests) to Focus on the Family, we recommend the following language:

I hereby give, devise and bequeath to Focus on the Family, a nonprofit organization located at 8605 Explorer Drive, Colorado Springs, CO, 80920, Federal Tax ID #95-3188150, ____ percent (___%) of the rest, residue and remainder of my estate to be used for Focus on the Family’s general use and purpose.

4. Contingent Bequests

If you would like to name Focus on the Family as a secondary beneficiary, in the event your primary beneficiary does not survive you, we suggest the following language:

If [name of primary beneficiary] does not survive me, I then hereby give, devise and bequeath _____ to Focus on the Family, a nonprofit organization located at 8605 Explorer Drive, Colorado Springs, CO, 80920, Federal Tax ID #95-3188150, [description of assets] to be used for Focus on the Family’s general use and purpose.